Listen now on Apple, Spotify or YouTube

In This Edition

- Circana shares data on US consumers

- ESA talks tariffs

- IGN’s Rebekah Valentine guest hosts!

- Death Stranding 2 sales

Welcome back to The Game Business.

Miserable news hit the games industry yesterday as Xbox cut staff, studios and games. Today’s episode of The Game Business Show, featuring the excellent journalist Rebekah Valentine, was recording just minutes before that news broke… so if you want to read my take on that news, you’ll need to head on over here.

Instead, this particular edition deals with the US economy and the impact tariffs, recessionary fears and rising prices will have on video game sales this year. This includes data revealed by Circana during last month’s The Game Business Live. Plus we spoke to ESA CEO Stanley Pierre-Louis.

You can catch our analysis of the news above (or listen on your podcasting platform of choice). Alternatively, I’ve featured many of the key facts and figures below.

What will rising prices and tariff fears do to video game sales?

US consumers are cutting back their spend on video games due to rising food prices, concerns about a recession, and the expected impact of tariffs.

That was according to Circana executive director Mat Piscatella, who presented the data at The Game Business Live last month.

During his talk titled: Tariffs and Affordability: The US Consumer In Limbo (which you can watch on YouTube here), Piscatella highlighted the macroeconomic challenges facing consumers, and the responses to sentiment surveys conducted by both Circana and CivicScience.

CivicScience saw an uptick in consumer sentiment at the end of 2024, but that dropped over the last few months, and as a result, positive consumer sentiment fell to the lowest point since July 2022.

Nevertheless, Q1 retail spending is resilient, with retail sales up 4.6% across all categories. This is despite a slump in GDP, with economic growth down 0.3% and inflation up 2.4%. So despite the headwinds, consumers were spending more during the first quarter of the year.

But the reason for that increased spend is pretty singular… food prices. Circana revealed that spending on food and beverages (including restaurants) was up 3%, non-edible goods (things in the grocery store you can’t eat) is up 2%, whereas general merchandise (including apparel and video games) is down 2%.

When you look at the number of products sold, food and beverage sales are flat, non-edible goods are down 1% and general merchandise is down 2%. In other words, people are spending more on food because it costs more, and are therefore spending less elsewhere.

Circana shared more data that revealed that average prices rose 2.3% in April compared with the year before, with utility costs up 15.7%, car insurance up 5.4% and shelter up 4%.

But food costs is the big issue, Piscatella said. 63% of consumers surveyed said they were extremely concerned by the price of food, while only 4% were not concerned at all.

When asked what consumers are doing about these concerns, 55% said they’re looking for more deals and sales, while 44% said they were cutting back on non-essential items (which include video games).

80% of US consumers are also concerned about a potential recession in the coming months, Circana revealed. As a result of this, 62% said they were watching what they spend more closely, and 46% said they were putting off big purchases.

“No matter when we talk to consumers right now, these are the two messages that are coming across most clearly,” Piscatella said on stage.

When it comes to the tariffs, consumers were a little more uncertain. Circana spoke to consumers in January, March and April about tariffs, and the results were widely different.

“We saw an uptick in game subscriptions when Call of Duty made it to Game Pass… but after that, we saw an uptick in February, and in March and in April.”

“We’ve seen dramatic swings every time we talk to consumers so far on where they stand on tariffs,” Piscatella told the audience.

“About 35% of people we spoke to in January probably didn’t know what a tariff was. They’d started to hear more about it by March, and the opposition of tariffs strongly increased. In January we had a net 9% support of tariff that was across the board, democrat supporters, republican supporters… it didn’t matter. By March, it had fallen to down 6%. By April with all the announcements made about it, it came back up a bit to a negative 1.1%. So consumers are still figuring this out. And the group in the middle, the 30% of consumers who still don’t know where they stand on tariffs, are waiting to see the impact.”

No matter the views on tariffs, the vast majority (69%) of people believe tariffs will result in higher prices. The differentiator between those who support and don’t support tariffs is around the impact on jobs and wages. Those who support tariffs believe it will have a positive impact on wages and employment, but those who oppose think it’ll have a negative impact.

As a result of the tariff uncertainty, 40% of consumers plan to cut back spend. And out of that group, around 30% said they plan to cut back on entertainment subscriptions and video games. So not everyone is going to cut back on gaming, but a proportion of the market is or will.

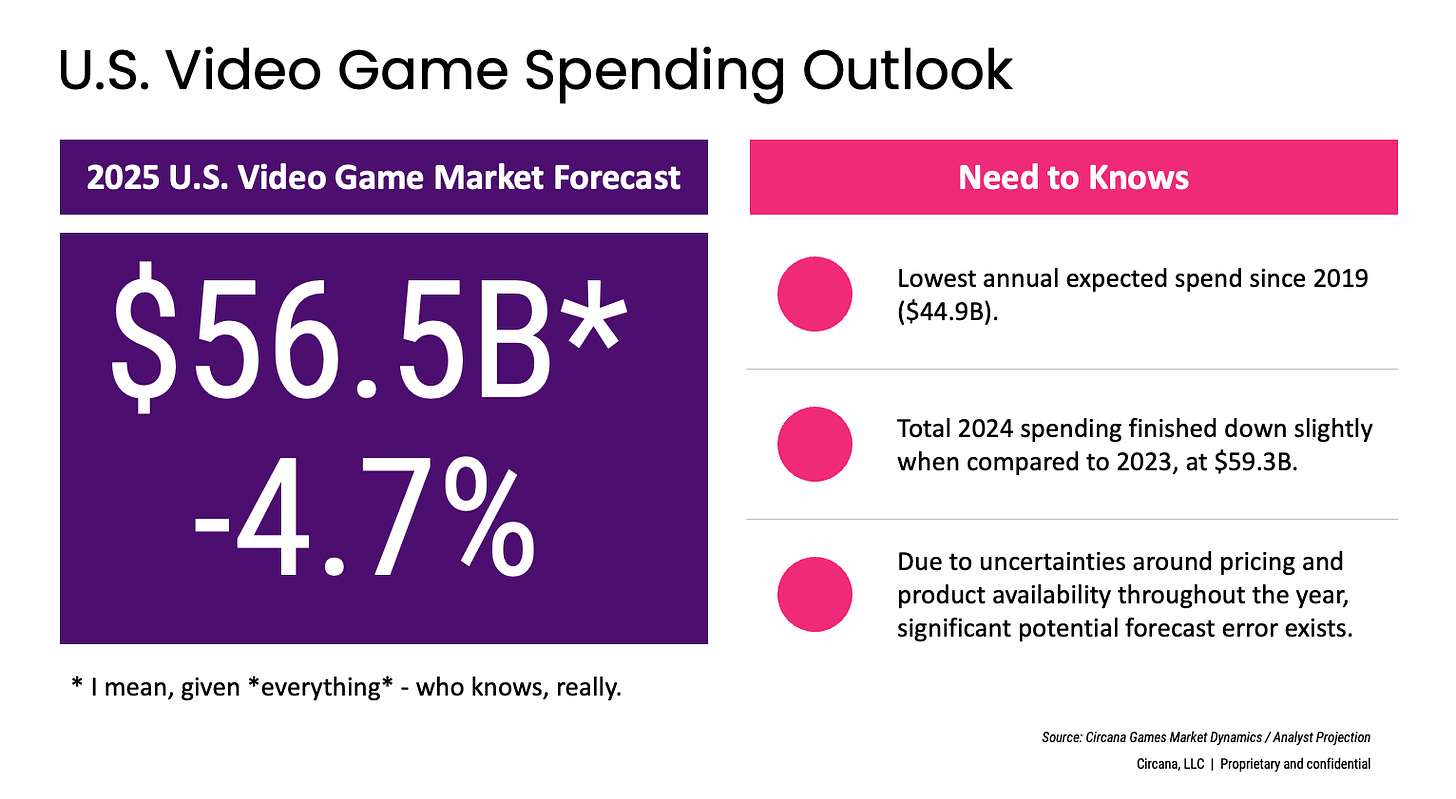

Circana has since changed its forecast for games. Initially it had predicted a 4.3% growth for games in 2025 (which admittedly was helped by the expected launch of Grand Theft Auto 6). Instead, now it expects revenue to reach $56.5 billion, which is a drop of 4.7% over the year before and the lowest number since 2019.

“Mobile is struggling a bit this year, the console space has been struggling a bit going into the launch of Switch 2, we will see how powerful and sustained that launch is,” Piscatella said. “But generally, we have a consumer who is a little bit concerned, is holding back a little bit, and really need to be pushed with the concept of value for their gaming dollar.”

Piscatella ended his talk with a few positive notes.

“People still love video games,” he said. “People are still very excited. It’s a wonderful category that continues to do amazing things. But they’re looking for value. We’ve been doing a lot of $80 games and subscription and free-to-play, but no matter what, the consumer has to believe they’re getting good value for their dollar.”

He added that this might be why subscription services have started to grow again this year: “We saw a subscription market boom during the pandemic window. Then it flattened. It was flat for a couple of years. We saw an uptick when Call of Duty made it to Game Pass… but after that, we saw an uptick in February, and in March and in April. That could be content related, but it also could be consumers saying ‘I want to have better value for my dollar, so I am going to lean into those categories that could deliver that’. So keep an eye on that.”

You can watch the full presentation with Circana’s Mat Piscatella below.

ESA has tried to make its case to US Government over tariffs

The US trade body the ESA has set out its case with Government over why it’s vital that video game consoles remain affordable.

Speaking to The Game Business as part of a wide-ranging interview, ESA CEO and president Stanley Pierre-Louis told us that tariffs remain one of the biggest concerns for US games companies in 2025.

“The most important thing for us is to be able to get games, and game playing devices, to the public and to do it at a reasonable cost,” he told us.

“And obviously tariffs can have a very difficult impact, depending on where they land. As an industry, what we’ve done is spoken to the administration to explain the value propositions that games bring. Of course, we agree with the goal of promoting and expanding American industries. And in many ways, the US is a top exporter of games, if not the top exporter of game, to the rest of the world. But to maintain that lead, you’ve got to get devices into the hands of consumers in an affordable way. We’ve raised those concerns with the administration, and we continue to work with them on understanding why what we bring to bear is critically important.

“When you think about the $59 billion that the [US] video game industry generated this past year, just under $5 billion of it is based on the consoles, and the overwhelming rest of it is on game content. So in many ways, consoles are the gateway to unlocking this enormous value proposition for consumers, and also the American economy. We’ve tried to make that case, and it’s been an important conversation point with the administration.”

This week, the US Government has announced that it will impose a 20% tariff on goods coming from Vietnam, which is down on the initially proposed 46% levy. Some game consoles are manufactured in Vietnam. However, a 40% tariff remains on products that are shipped to Vietnam from China, in a process known as ‘trans-shipping’.

Meanwhile…

Data firm Ampere estimates that Death Standing 2: On The Beach sold 1.4 million copies by the end of June. The game has had a slower start than the original in terms of physical sales across Europe, but digital sales have been stronger.

Xbox has closed The Initiative and cancelled its Perfect Dark reboot. It’s cancelled Rare’s upcoming new IP Everwild. It’s cancelled a number of unannounced projects. It has cut staff at studios including Turn 10, King, Blizzard, Zenimax and more. It’s also reduced PR, marketing and community roles across the firm’s various publishing groups. I gave my thoughts on the situation here.

Kotaku is now owned by digital publishing company Keleops, which will retain all staff and says it will hire more senior employees. Kotaku was owned by G/O Media, which also operated Gizmodo, another publication that Keleops purchased latst year. G/O Media will now wind down its operations.

Former Ubisoft leaders Thomas François, Serge Hascoët, and Guillaume Patrux have received suspended prison sentences for sexual and psychological harassment. François, who worked as VP of editorial, received a three-year suspended sentence and fined €30,000 for sexual and psychological harassment and an attempted sexual assault. CCO Hascoët was given an 18-month suspended sentence and fined €45,000 for psychological harassment and ‘complicity in sexual harassment’. Meanwhile, game designer Patrux was fined €10,000 and received a 12-month suspended sentence for psychological harassment.

Hooded Horse has teamed up with Ubisoft and developer Unfrozen to publish Heroes of Might and Magic: Olden Era. Hooded Horse will serve as publisher, but Ubisoft will continue to support where relevant.

11-Bit Studios has admitted it accidentally left AI-generated text in its game The Alters. It was supposed to be temporary work-in-progress text, the firm said, but made it through to the final product. The developer also admitted it used AI translation to localise some last-minute video additions to the game.

NDreams co-founder Tamsin O’Luanaigh, who also served as the developer’s chief people officer, has formed Wild Cat Strategy. The new consultancy is designed to support and create productive, collaborative work environments for game developers.

Naughty Dog’s Neil Druckmann is stepping away from his involvement in the HBO adaptation of The Last of Us to focus on video games. Druckmann’s current role at Naughty Dog includes writing and directing the upcoming Intergalactic: The Heretic Prophet for PlayStation 5.

That’s it for today. Join us next week for our big interview with mobile games giant Zynga. Until then, thank you for reading.