Listen now on Apple, Spotify or YouTube

In This Edition

- Release date debate

- The new GDC

- Fortnite’s monetisation U-turn

Hello there!

Today, we dive into video game release dates, featuring the latest stats from Newzoo. We also welcome the data firm’s director of market intelligence Emmanuel Rosier onto our Show.

Rosier shares his views on where the industry may be going wrong when it comes to setting dates, and we also chat about Epic Games’ Fortnite monetisation U-turn, the Xbox price rises, and the rebrand of GDC.

For those not in the listening/viewing mood, I’ve shared some of that data (including my own thoughts) in written form below. Plus, my reading of the new-look GDC.

Enjoy!

Newzoo thinks some AAA companies are getting release dates wrong. But is that fair?

Video game analytics firm Newzoo issued a report this week on the trends around release dates in video games.

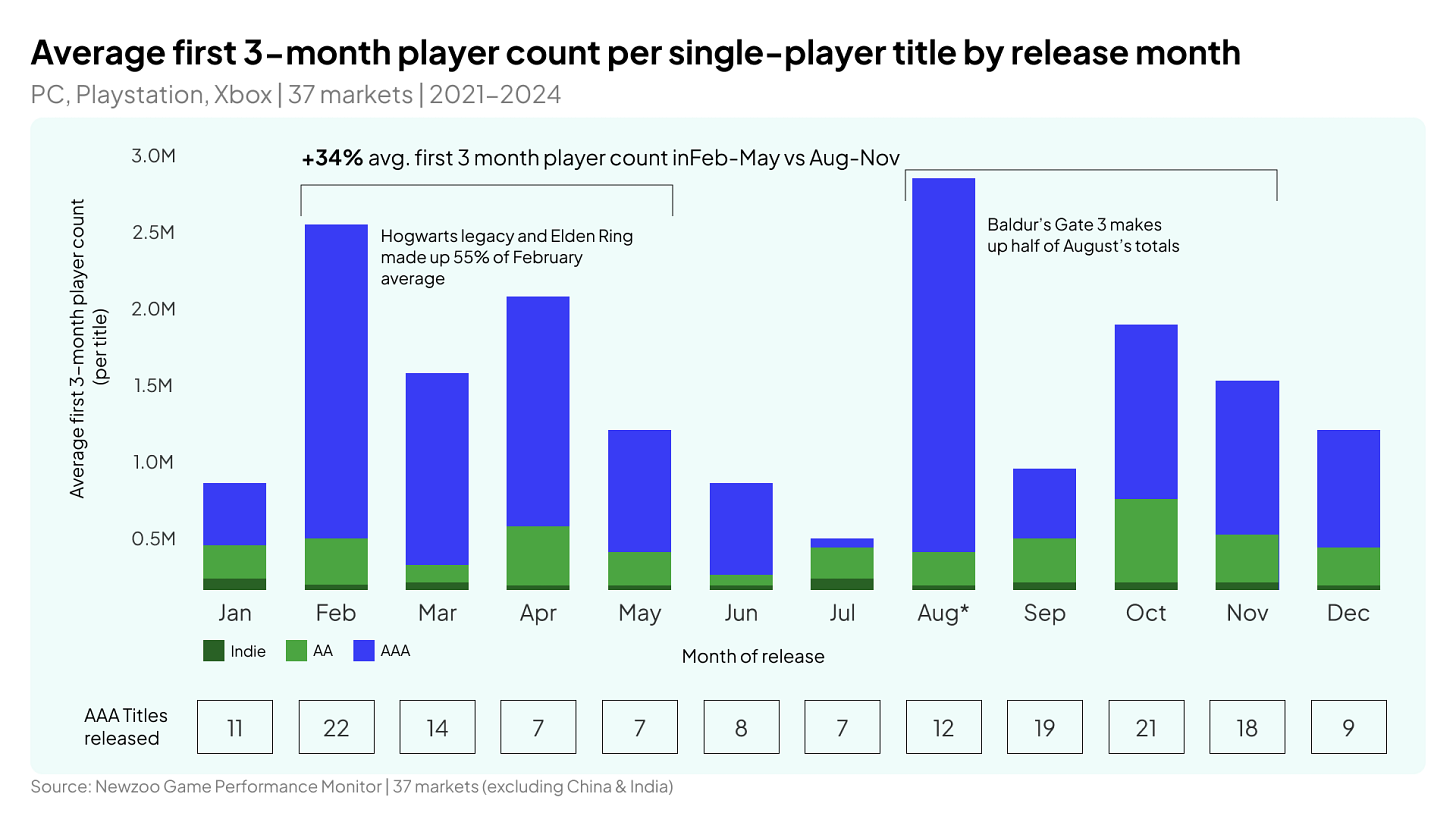

The firm analysed 155 AAA single-player games released between January 2021 and December 2024 (AAA means any game priced over $60, or remasters of AAA games). And this is what they found:

Nearly 70% of AAA single-player games were released in just five months of the year. 45% between mid-August and mid-Novenmber, and 23% in February and March

Only 14% of titles are released in Q2

In terms of the average player count per title (over a three month period), games released in April, May and June carry as much engagement as games released in September, October and November

For 2025, 25% of single-player games with a $60+ price tag are coming out this month (September)

Newzoo’s conclusion is that some game companies are still mostly reliant on traditional release windows and getting games out in time for fiscal reporting. With people playing fewer games, and with increased costs impacting discretionary spend, the need to spread out releases has never been higher. Indeed, Newzoo suggests that unless a game is a top priority for players, they may wait until the game is discounted.

Newzoo also observes that marketing costs are higher at the end of the year, and therefore it is more costly to release games during that October/November window.

The firm concludes that “clustering AAA single-player releases, especially between mid-August and mid-November, strongly correlates with weaker performance. In contrast, months like Q2 see far fewer releases, yet deliver equal or greater engagement compared to Q1 or the crowded fall slate’.

We delved into the analysis on this week’s episode of The Game Business Show, featuring Newzoo’s director of market intelligence Emmanuel Rosier. And during the conversation we discussed many of the considerations that go into setting a release date.

For instance, the mid-November to mid-December period is typically quieter, and the big reason for this would be to avoid the Black Friday sales. If you release a large AAA $60 game during that window, you’ll find yourself competing with relatively new large AAA games for (potentially) half the price.

As Newzoo states, releasing a game in December can also be costly from a marketing point-of-view. And although this is unlikely to be a determining factor, releasing in December does mean your title will likely miss out when it comes to awards season and Game of the Year lists.

January is typically a tricky month for two reasons. Money is often tighter for consumers post-Christmas, and also some gamers may have received titles for Christmas that they are busy playing. One Ubisoft exec told me that the publisher likes to release games mid-February to early March because “players are likely to have finished their Christmas games by then”.

April is also typically quieter, and Rosier suggests that is the result of companies getting their titles out before the end of the fiscal year (which is typically the end of March).

But generally, Q2 is inconsistent when it comes to how quiet it is. This year, for example, there was the remaster of Elder Scrolls IV: Oblivion, Clair Obscur: Expedition 33, the Nintendo Switch 2 launch, Doom: The Dark Ages, Elden Ring Nightreign and Death Stranding 2: On The Beach. 2023 was also a particularly noisy Q2, with games such as Dead Island 2, Star Wars Jedi: Survivor, The Legend of Zelda: Breath of the Wild, Hogwarts Legacy (PS4 and Xbox One versions), Diablo 4, Final Fantasy 16 and Street Fighter 6.

And of course, next year Q2 will see the release of Grand Theft Auto 6.

Finally, Newzoo’s data shows that July is the worst month when it comes to AAA game engagement, (based on 3-month player count).

So, if January, July and December have clear drawbacks, and April, May and June can sometimes be busy (depending on the year), is it fair to say game companies are getting it wrong when it comes to release dates?

And the industry has shifted. Assassin’s Creed Shadows released in March this year, for example, which is the first time a major mainline Assassin’s Creed didn’t release during Q4.

Go back further, and actually the annual release cadence for games feels radically different. Take a look at this release schedule from November 2008. Between November 7 – November 18, an 11-day period, the following games were released: Call of Duty: World at War, Gears of War 2, Pokémon Ranger, Banjo-Kazooie: Nuts and Bolts, Mirrors Edge, WWE Smackdown vs Raw, Star Wars The Clone Wars, Pro Evolution Soccer 2009, Football Manager 2009, World of Warcraft: Wrath of the Lich King, Left 4 Dead, Need for Speed Undercover, Tomb Raider Underworld, Sonic Unleashed, Animal Crossing City Folk, Mortal Kombat vs DC Universe, Shaun White Snowboarding… and a whole load more besides.

In the weeks leading up to that onslaught of games, we also saw the launch of Fallout 3, Far Cry 2, Fable 2, LittleBigPlanet, Dead Space, plus new games in the Spyro, Spider-Man and Motorstorm franchises.

Now that was a congested release window.

There have been times where I’ve been caught out by release date decisions. Sonic Superstars and Super Mario Wonder launching the same week, for example. Or Clair Obscur: Expedition 33 and Oblivion going into Game Pass at (practically) the same time. Or the sheer number of games 2K has been publishing over the last few months. I’ve actually asked senior people at these companies to explain those decisions, and I couldn’t get straight answers outside of an acknowledgement that the situations were ‘not ideal’.

In addition, the games market is unpredictable. You’re not just facing new releases, but older games that might be discounted, or a live service title with a big update, or an indie hit that’s come out of nowhere and caught the public’s imagination.

In October 2023, Remedy released Alan Wake 2. I was concerned for the genuinely excellent horror game. It was a busy release window, with the likes of Spider-Man 2 and Assassin’s Creed Mirage competing for time and money.

A few months later I spoke to Remedy about the release timing. And the firm pointed out that if the game had launched in Q1, it would have been up against Palworld and Helldivers 2 instead, which were two games that unexpectedly dominated sales in January and February 2024.

Newzoo’s data focuses on AAA releases. But in today’s market, even the biggest brands can find themselves humbled by a new IP or a AA/indie hit.

Ultimately, Alan Wake 2’s proximity to Spider-Man 2 wasn’t idea. But it was still a horror game released near Halloween. It was also a title of the highest quality, released in time for the awards season (where it picked up numerous prizes). And over time that game found an audience (albeit slower than Remedy perhaps had hoped).

Mafia: The Old Country and Borderlands 4 coming from 2K in quick succession might seem unnecessary, but both games will still be new, but not too new, by the time Black Friday rolls around, giving 2K a chance to reach more price-conscious players.

The days where games only had a few weeks to sell before they ended up on the pre-owned shelves are over. A release strategy is not just about launch, but what comes after, whether that’s a DLC drop, a Steam sale or an awards opportunity.

Newzoo’s data is super interesting. This is an age where you can release a game at almost any time and find a huge audience (well, maybe not July). And there are promising release windows that are (usually) quieter than most.

But in a market as changeable as video games, and during a time when a game’s lifecycle strategy is as important as the launch, you can see why so many publishers choose to focus on what they can control, rather than worry too much about what their competitors are doing.

GDC has changed… or has it?

GDC has a new name. It’s called GDC Festival of Gaming.

Cutting through the PR, GDC is positioning itself as a city-wide series of events. There is the core conference (which it is also going through some changes), but the organisers are also highlighting off-site meeting opportunities, networking events, showcases and awards.

But in real terms, it feels more like an official acknowledgement of GDC has always been. It’s not uncommon for attendees to go to San Francisco and, rather than attend GDC itself, spend much of their time taking part in off-site networking dinners, investor events, press showcases and meeting systems. Last year, several exhibitors chose not to appear on the GDC expo floor, and instead booked hotel suites to meet with potential clients.

This activity is a real threat to GDC. And the organisers are reacting by embracing the wider events, and (hopefully) making it simpler for attendees.

It’s a key strategic shift for the GDC business. But for those in attendance, it might not feel all too different to what came before.

Meanwhile…

Xbox console prices are rising again in the US due to financial pressure caused by tariffs. The Series S models will increase by $20, with the Series X range is rising by $50. The cheapest Xbox Series S will now cost $400, while the cheapest Xbox Series X will set users back $600.

PlayStation has announced a string of games for 2026. Saros from Housemarque will launch on March 20, while Marvel’s Wolverine from Insomniac is scheduled for the end of the year. The two titles join a strong year for AAA PS5 titles, with third-party projects like 007 First Light, Resident Evil 9 and GTA 6 also scheduled for release.

Forza Horizon 6 is coming next year, and will be set in Japan. The game is coming to PS5, but not at launch, which might initially hinder the game’s potential in the Japanese market (I would suggest a Switch 2 version might do well, too). It’s a big year for developer Playground Games, which is also releasing its take on Fable next year.

London Games Festival will take place Monday, April 13 – Sunday, April 19. The event has secured additional Government funding, which will see the organisers further expand its Games Finance Market (April 14 – April 15), and its New Game Plus consumer event (April 16 – April 17).

Publisher Midwest Games has secured $2 million from Kansas City’s Prevail Private Capital, a new investor in the games space. The support is to help the firm ‘redefine publishing support’. Midwest Games was formed in 2023 by Netflix exec Ben Kvalo and XSET veteran Rob Martin.

Roblox has hired Vlad Loktev as chief creator ecosystem officer within its creator division. His job will be to support creators through development tools, developer relations and events. Loktev spent most of his career at AirBnB, but initially built games at Zynga. Prior to Roblox, he was a partner at Index Ventures.

Indie publisher PlayStack has posted some impressive financial results. The firm’s revenue for the first half of 2025 increased 52% to £30.7 million ($41.5 million) compared with the year before. This was driven by popular titles Balatro and Abiotic Factor, which sold a combined three million copies during the period.

That’s it for today’s episode of The Game Business Show. We will be back on Monday with a new edition to our weekly schedule for paid subscribers. Until then, thank you for reading!