Listen now on Apple, Spotify or YouTube

In This Edition

- The big shooter showdown

- Epic and Unity make friends

- Ralph Panebianco (Skill Up) on the games media

Hello and welcome to another edition of The Game Business.

It’s our Thursday Newsletter and Show, so it’s time for a bit of news and analysis. And to help us dissect all the business news this week is YouTuber and media entrepreneur Ralph Panebianco (or Skill Up as he’s also known).

Ralph and I chat about the Unity/Epic partnership, the row between Rockstar and the Independent Workers’ Union of Great Britain, the success of the ROG Xbox Ally X, the F1 franchise taking a year off (sort-of) and his new media website This Week In Videogames.

But our big topic is about the shooter genre. Specifically, the challenges faced by Call of Duty and the early success of Battlefield 6 and Arc Raiders, with exclusive data supplied by Ampere.

We also chat Bungie, Fortnite and the prospect of a Half-Life 3.

If you want to hear or watch the whole thing, you can check it out above. Alternatively, check out my analysis below.

Enjoy!

Shooter showdown: Call of Duty under fire

Call of Duty: Black Ops 7 has launched with record low player figures on Steam, and negative feedback from fans.

The game has also arrived in a strongly competitive market for new shooters, with the likes of Battlefield 6 and Arc Raiders achieving high sales figures during October and early November.

During its launch weekend, Call of Duty: Black Ops 7 peaked at around 100,000 concurrent players on Steam, which is well below the 300,000 achieved by 2024’s Black Ops 6, and even below the 190,000 that 2023’s Modern Warfare 3 managed to hit.

Steam has historically been a weaker platform for Call of Duty (the franchise hasn’t always been available on the platform). And if you compare the game’s Steam performance to the two big shooters of last month, Battlefield 6 hit 747,000 concurrent Steam users during its launch, while Arc Raiders has just peaked at 482,000 players (Newzoo analysis).

It’s too early for any concrete console data (check back with us tomorrow), although some early figures do point to a decline here, too. In the UK, the physical launch sales for Black Ops 7 is down 61% over the launch of Black Ops 6 (GfK data).

The launches of Battlefield 6, Arc Raiders and Black Ops 7 has caused a shake-up in the shooter space over the last six weeks. To get a sense of what is happening, Ampere Analysis has provided The Game Business with data that reveals what the users of these three games had been playing ahead of their release.

Looking at Battlefield 6, the EA game clearly had an impact on the Call of Duty audience. According to Ampere’s data, around a quarter of Battlefield 6 players on PlayStation and Xbox had been playing Call of Duty the month prior (on Steam, it’s not quite so severe with just a 3.5% overlap between the two games, reflective of the game’s relatively low performance on the store).

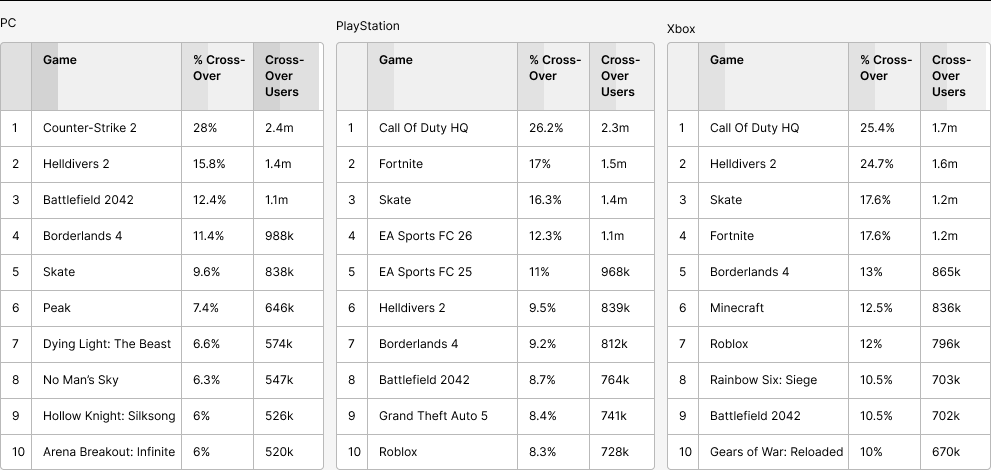

As you can see from the graph below, Battlefield 6 players were also playing the likes of Counter-Strike 2, Helldivers 2, Fortnite, Skate and Borderlands 4 in September.

What Battlefield 6 users were playing the month before release (Ampere data)

Things are slightly different when it comes to what Arc Raiders users had been playing the month prior.

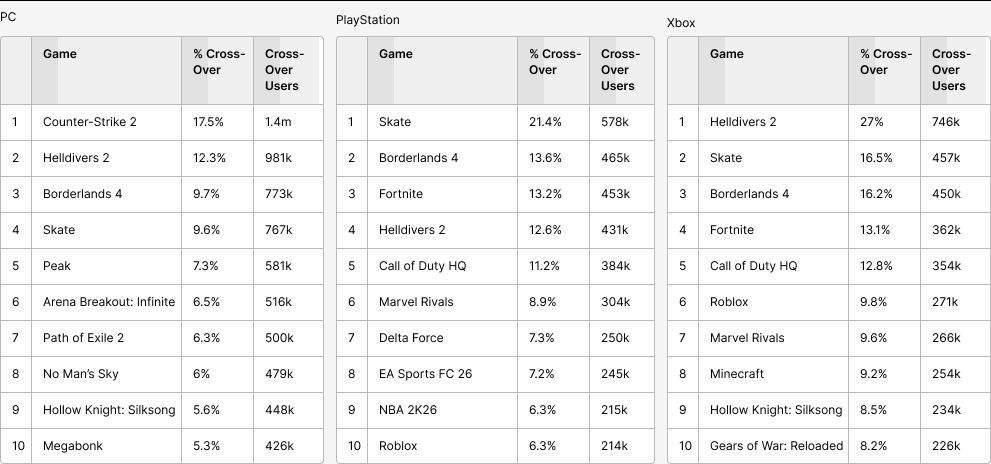

The biggest difference is with Call of Duty. Compared with Battlefield 6, Arc Raiders (which is an extraction shooter) had a relatively low cross-over with COD, just 11% on PS5 and 13% on Xbox (and like Battlefield 6, a very small cross-over on Steam).

Indeed, Arc Raiders primarily disrupted more recent games. On PlayStation, 21% of Arc Raiders players had played Skate the month before, with 13.6% playing Borderlands 4, which were both released in September. On Xbox it’s a similar situation, the game with the most cross-over with Arc Raiders was Helldivers 2 (that game released on Xbox at the end of August), Skate and Borderlands 4.

51% of Arc Raiders players played a shooter game in September, vs 72% for Battlefield 6.

This suggests that Arc Raiders was particularly popular with players that like to experience a variety of different games and are more likely to hop around from title to title. It did appeal to players of legacy live service games, too, but not as much as Battlefield 6 did. Perhaps an illustration of this is on Steam. The No.1 game cross-over for both Arc Raiders and Battlefield 6 on Steam was with Counter-Strike 2. However, just 17% of Arc Raiders players were on Counter-Strike 2 the month prior, compared with 28% of Battlefield 6 users.

And here’s another interesting Ampere stat. In terms of audience, 51% of Arc Raiders players played a shooter game in September, vs 72% for Battlefield 6.

What Arc Raiders users were playing the month before release (Ampere data)

Call of Duty’s big challenge

A new Call of Duty release tends to achieve two things. First, it engages existing players with new content and modes. Second, it brings in new and returning players, including those that perhaps like to jump around between titles.

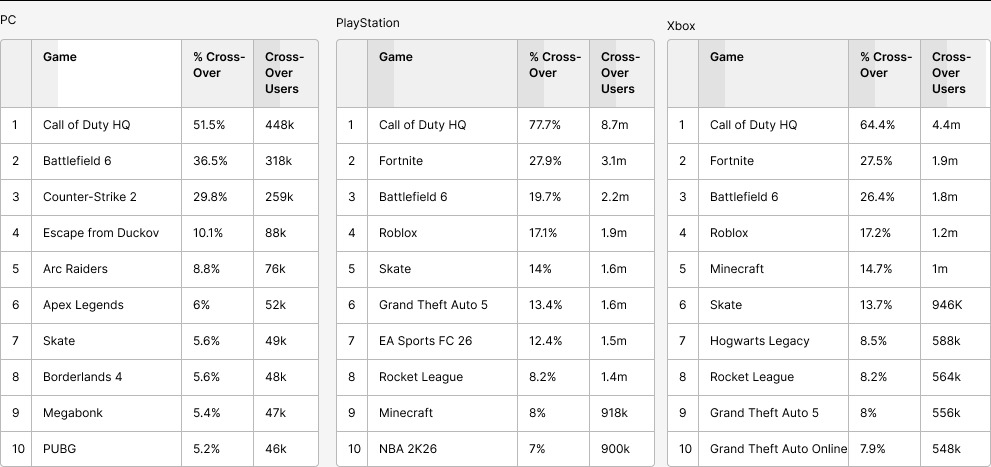

Compared to previous Call of Duty games, Black Ops 7 faced some challenges with those two things as a result of this increased competition. First, it had to deal with the fact that Battlefield 6 had managed to appeal to some of its core players. Ampere data suggests that COD did see some success here. Across the three platforms, nearly 4.5 million Call of Duty players last weekend had previously played Battlefield 6.

As for that second audience of floating players that like to move from game-to-game, a number of those are clearly playing the new Arc Raiders, which only arrived a few weeks ago. On Steam, 8.8% of Call of Duty players had played Arc Raiders previously, but the game doesn’t feature on either the PlayStation or Xbox cross-over lists. It suggests COD hasn’t had that much of an impact on this title (yet).

One other big title that has been infringing on Call of Duty’s base has been Fortnite. Fortnite released its big The Simpsons update at the start of the month, which would have appealed to slightly older audiences (which is the Call of Duty audience). On console, five million Call of Duty players last weekend came from Fortnite (PC data is unavailable).

What Call of Duty users were playing the month before release (Ampere data)

Although it’s clearly a competitive space, Call of Duty has the brand recognition and popularity to fight back. However, the game has received a somewhat negative reception from fans. The game reviewed well with critics, but it has the lowest Metacritic score amongst gamers, and there is negative sentiment on its Steam page, too. This dissatisfaction from some users is on a variety of different issues, ranging from the inability to pause the campaign mode, the apparent use of AI assets, and the risks that the developer has taken in trying to do new things.

It’s worth noting that there has been some fan unhappiness with the latest updates to Battlefield 6, too, which has impacted that game’s user score.

The real victim? Helldivers 2

All this competition does mean there are games that get caught in the cross-fire. And one such title has been Helldivers 2.

The Sony game enjoyed a huge spike in users during September, driven by its release on Xbox and a new update to the game. But user numbers dropped by around 45% (Ampere and Newzoo data) during October, and as you can see from the graphs above, there was a strong cross-over between Helldivers 2 players and those that jumped into Battlefield 6 and Arc Raiders. The game lost over four million players last month.

It’s certainly a competitive market. However, for all the reports that have been written about gamers being reluctant to move between online games, the battle of the shooters shows there are still a huge number of that do move… whether that’s from Skate to Battlefield, Helldivers to Arc Raiders, or Fortnite Simpsons to Call of Duty.

The fact there are three big new shooters fighting for attention in the market is the sort-of excitement the industry thrives on. It drives interest and raises the bar in terms of quality, and gets people trying new experiences.

And with the prospect of Bungie’s Marathon, the return of Halo and (whisper it) Half-Life in 2026, it’s clearly a strong time for fans of shooting games.

Meanwhile…

Fierce rivals Epic Games and Unity came together this week to announce two collaborations. First, Unity games can be published to Fortnite, which supports Epic’s open metaverse ambitions. And second, Unity’s cross-platform commerce platform will be added to Epic’s Unreal Engine, which offers developers more options on selling games direct to consumers on PC and mobile (another key Epic initiative).

EA has announced there will be no F1 game next year. Instead is preparing a paid DLC expansion to the current game, which will update the current game with new cars, drivers, teams and rules associated with the 2026 F1 season. A full new game is being worked on for 2027.

The ROG Xbox Ally X has exceeded expectations, according to Asus. The firm expects its Ally range of PC handhelds to generate between $96 million and $160 million this current fiscal quarter, and approximately $130m and $160 million per quarter going forward.

The finalists are here for The Game Awards. The six battling it out for the Game of the Year award are Clair Oscur: Expedition 33, Death Stranding 2: On the Beach, Donkey Kong Bananza, Hades 2, Hollow Knight: Silksong and Kingdom Come: Deliverance 2. In terms of the top publishers, Sony secured 19 nominations overall, Kepler achieved 13, both EA and Microsoft are tied on 10, Sega got seven, Supergiant six and Team Cherry five.

GDC’s latest salary survey reveals that the average salary for US game industry workers is around $142,000. 80% of respondents said their current salary meets or exceeds their basic needs, but more than half (53%) said they feel undercompensated based on their role, experience, and market conditions. That number increases to 69% for contractors, consultants, and people working part-time. Meanwhile, 60% of women and non-binary people report feeling undercompensated, compared to 50% of men. 62% of non-white game professionals also felt undercompensated, compared with 50% who solely identify as white.

That’s it for this week. Join us for more market data and analysis tomorrow. And we’ll be back next week with our big Tekken interview. See you then.